Rep. Dennis Kucinich (D-OH) has this to say about the recent bailout bill:

"If Wall Street does come back for another bailout, we must be prepared in advance to say NO," Kucinich said in a press release Monday. "The bailouts of Wall Street must stop. It will never be enough. When the Federal Government gets involved in picking winners and losers on Wall Street, we open up a financial whirlpool of insatiable greed."The main problem I have with Kucinich's statement is that the

an American social ideal that stresses egalitarianism and especially material prosperity ; also : the prosperity or life that is the realization of this idealGreed is what drives Bush's war in Iraq, high gas prices, pork-based incentives to pass a bailout bill, and good old fashioned lobbying. Greed is also what drove the economy off a cliff.

While people would like to point their fingers at the non-savvy consumers who should've known better than to enter risky loans, the fact of the matter is that the lenders are the ones who got the ball rolling. Banks are in business for one reason, and one reason only: to make money. That means they will keep coming up with ingenious methods (ATM fees, currency exchange fees, sneeze fees, etc.) of accomplishing that one task while simultaneously making the consumer feel great about doing business with them (toaster, shotgun, glass of wine). Subsequently, they figured out a way to lend money to consumers with the most risk by coming up with unbelievable loan structures, like the interest-only loans which look good the first few years but pack a might wallop when the principal kicks in. Should the consumers have thought about these deals more before taking them on? Sure, but for a bank that's in business to make money, it's in the bank's interest to not completely care if the terms of the loan aren't completely clear to the borrower. Perhaps the lenders should've been more forward thinking about the risks involved instead of shuffling the mortgages off to other institutions so that defaulting loans can have a ripple effect down the entire chain.

But that level of greed cannot compare to what's coming out at these bailout hearings. You have to stand in awe of that greed. As Spudsy pointed out earlier, the CEO of Lehman Brothers supposedly didn't see the storm coming, and "feels bad" about what happened while he's sitting with over $300 million in the bank. Add to that the chutzpah of Lehman's board throwing $20 million to departing executives during Lehman's request for a federal bailout.

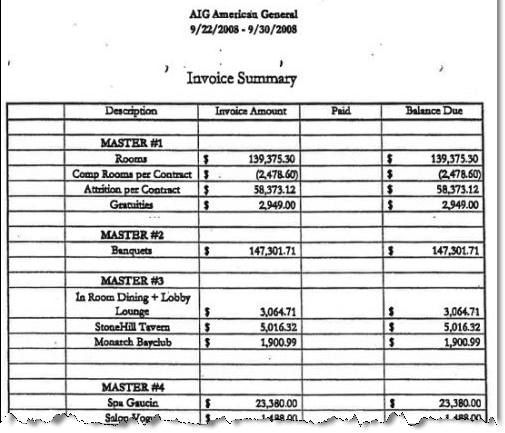

Today, there was an interesting discussion with regards to what AIG did after receiving their government bailout: They spent a fuckload of money at a resort.

(Full invoice on The Gavel)

Have you heard of anything more outrageous - a week after taxpayers commit $85 billion dollars to rescue AIG, the company’s leading insurance executives spend hundreds of thousands of dollars at one of the most exclusive reports in the nation…Let me describe for some of you the charges that the shareholders, taxpayers, had to pay. AIG spent $200,000 dollars for hotel rooms. Almost $150,000 for catered banquets. AIG spent $23,000 at the hotel spa and another $1,400 at the salon. They were getting manicures, facials, pedicures and massages while American people were footing the bill. And they spent another $10,000 dollars for I don’t know what this is, leisure dining. Bars?Maybe what the government should do is find a way to dump all of its newly acquired shares back on the market so these resort lovers can crash and burn. Seriously, where does this complete head-up-the-ass judgment on AIG's part come from?

Maybe from a society that values greed and power above all else.

Shakesville is run as a safe space. First-time commenters: Please read Shakesville's Commenting Policy and Feminism 101 Section before commenting. We also do lots of in-thread moderation, so we ask that everyone read the entirety of any thread before commenting, to ensure compliance with any in-thread moderation. Thank you.

blog comments powered by Disqus